District

Parent Resources

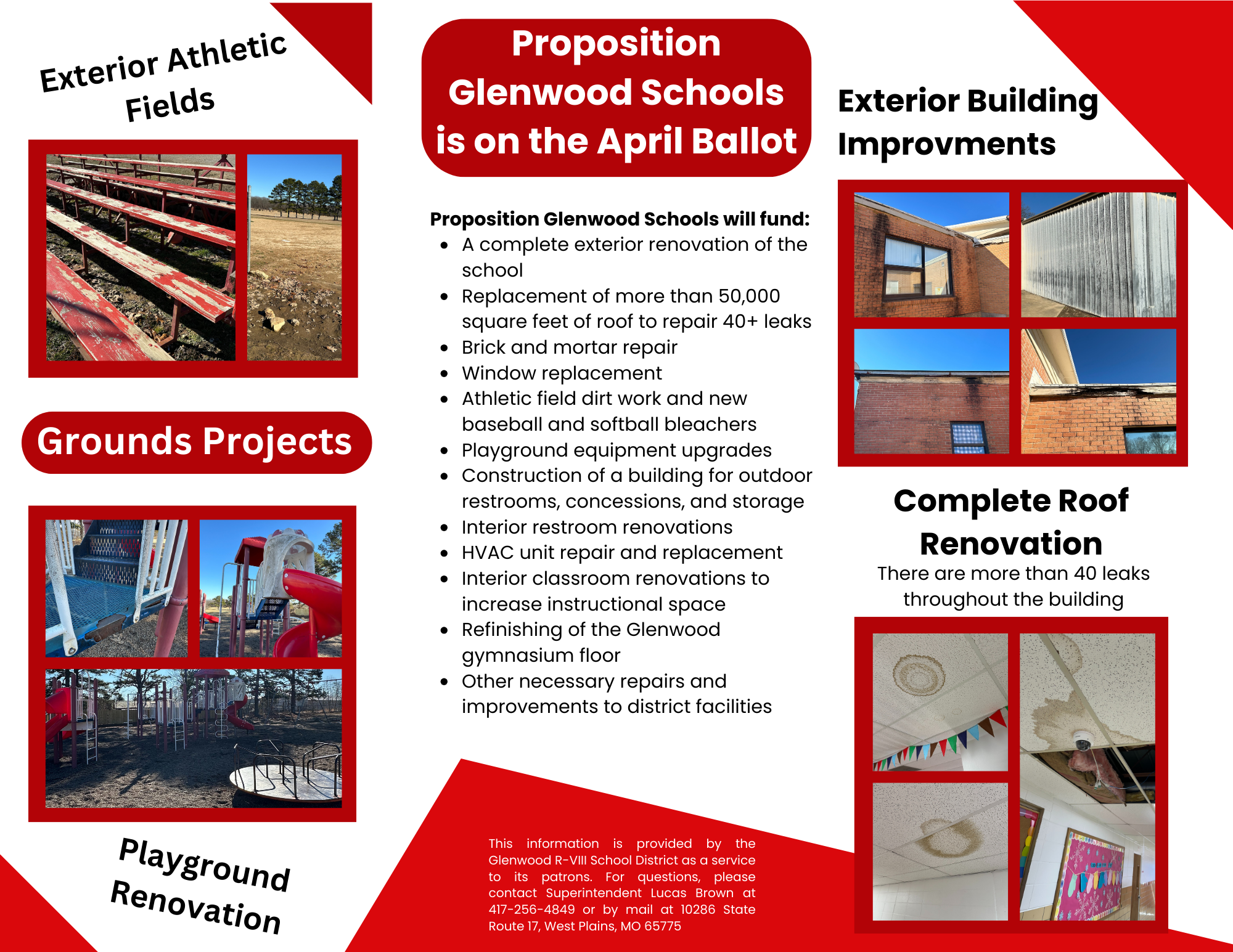

The Glenwood R-VIII School District is announcing Proposition Glenwood Schools, a $2,000,000 general obligation bond issue that will be placed on the April 2, 2024 ballot to support needed repairs and improvements across the district. If approved by the voters, this bond issue would fund a number of renovation and improvement projects for the district, with the largest project being the renovation and/or replacement of more than 50,000 square feet of roof. There are currently more than forty major leaks in all parts of the Glenwood school building due to the deterioration of the current roof, fascia board, and improper drainage. Other exterior building improvements would include the replacement of aging windows, brick and mortar repair, and upgrading the front entrance.

There are a number of projects inside the building that would be funded by this general obligation bond issue as well. Projects would include heating and cooling unit repairs and replacement, restroom renovations, and interior classroom renovations to increase instructional classroom space in the building. The gymnasium floor would also be refinished/repainted with these funds. These repairs, improvements and replacements would help to enhance the learning environment for all students and staff.

There are also plans to use these funds for projects that would improve school grounds. These funds would be used to construct a building between the baseball and softball fields that would contain a concession stand, restrooms, and athletic storage space. Also, new bleachers would be added for the softball and baseball fields, dirt work to improve drainage around the baseball field would be completed, and playground equipment would be replaced and upgraded.

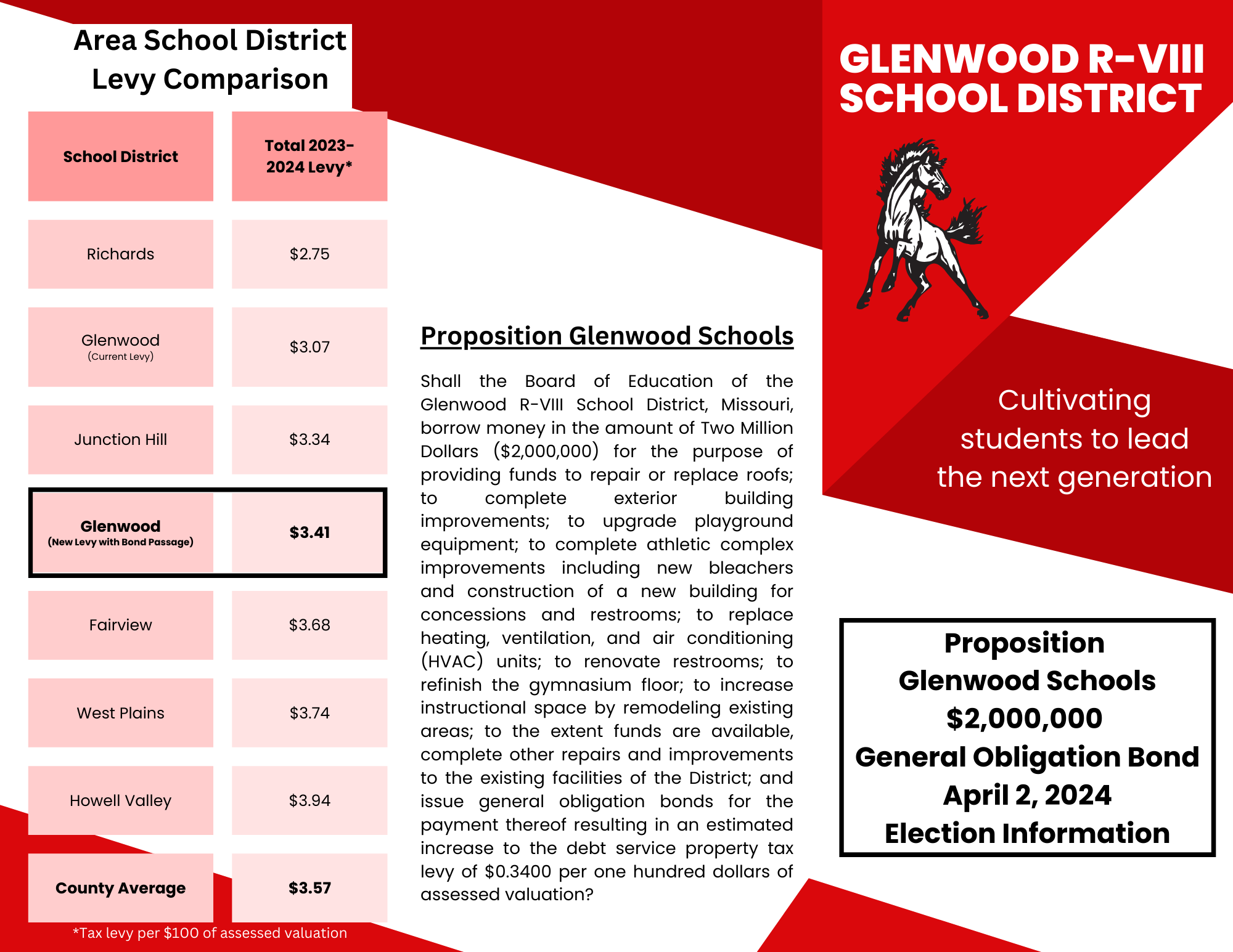

This general obligation bond issue would result in a debt service property tax levy of $0.34 per $100 of assessed valuation. Currently, Glenwood has an operating tax levy set at $3.07 per $100 of assessed valuation. This is the second lowest total levy of West Plains area schools, and below the county average of $3.57 per $100 of assessed valuation. With the passage of this bond issue, the new total Glenwood tax levy would be set at $3.41 per $100 of assessed valuation. For reference, the median home price in the Glenwood School District is $179,000. This tax levy would result in a total annual tax increase of $115.63 for a median priced home in the district, which is an increase of approximately $9.64 per month.

Please direct any questions you may have regarding this general obligation bond issue to Glenwood Superintendent Lucas Brown. You can reach him by email at lbrown@glenwood.k12.mo.us, or by phone at 417-256-4849. Written correspondence can be mailed to Glenwood R-VIII School District, 10286 State Route 17, West Plains, MO, 65775.